Food and Beverage Processing Equipment Market Size to Worth USD 122.32 Billion by 2035 | Towards FnB

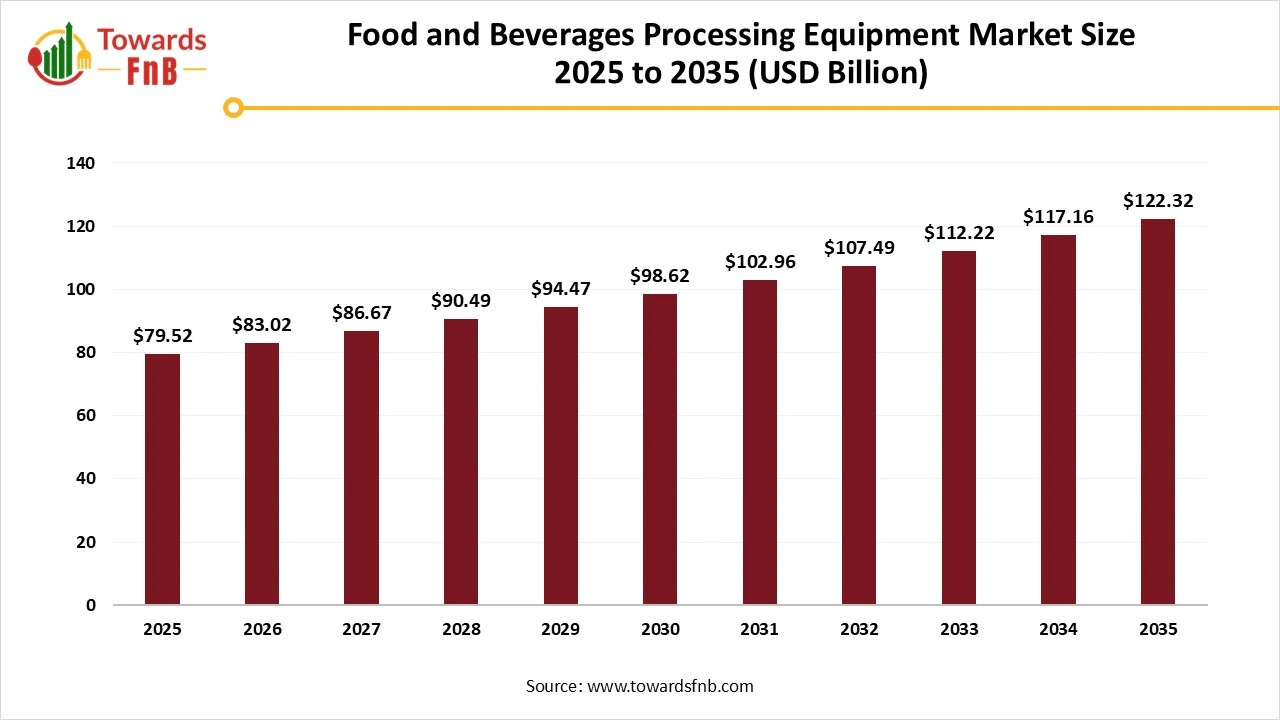

According to Towards FnB, the global food and beverage processing equipment market size is calculated at USD 83.02 billion in 2026 and is forecast to reach USD 122.32 billion by 2035, reflecting at a CAGR of 4.4% from 2026 to 2035. This expansion is supported by rising production of processed foods and increased adoption of automated and technologically advanced processing systems across global food manufacturing facilities.

Ottawa, Jan. 13, 2026 (GLOBE NEWSWIRE) -- The global food and beverage processing equipment market size stood at USD 79.52 billion in 2025 and is predicted to grow from USD 83.02 billion in 2026 to reach around USD 122.32 billion by 2035. A report published by Towards FnB, a sister firm of Precedence Research, highlighting steady investment in automation, food safety, and high-efficiency processing technologies across the industry.

The growing demand for processed food options and the increasing use of automation in machinery are major factors driving the market's growth. The market also observes growth due to higher demand for technologically advanced machinery that yields a flawless final result with less effort.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5974

Key Highlights of the Food and Beverage Processing Equipment Market

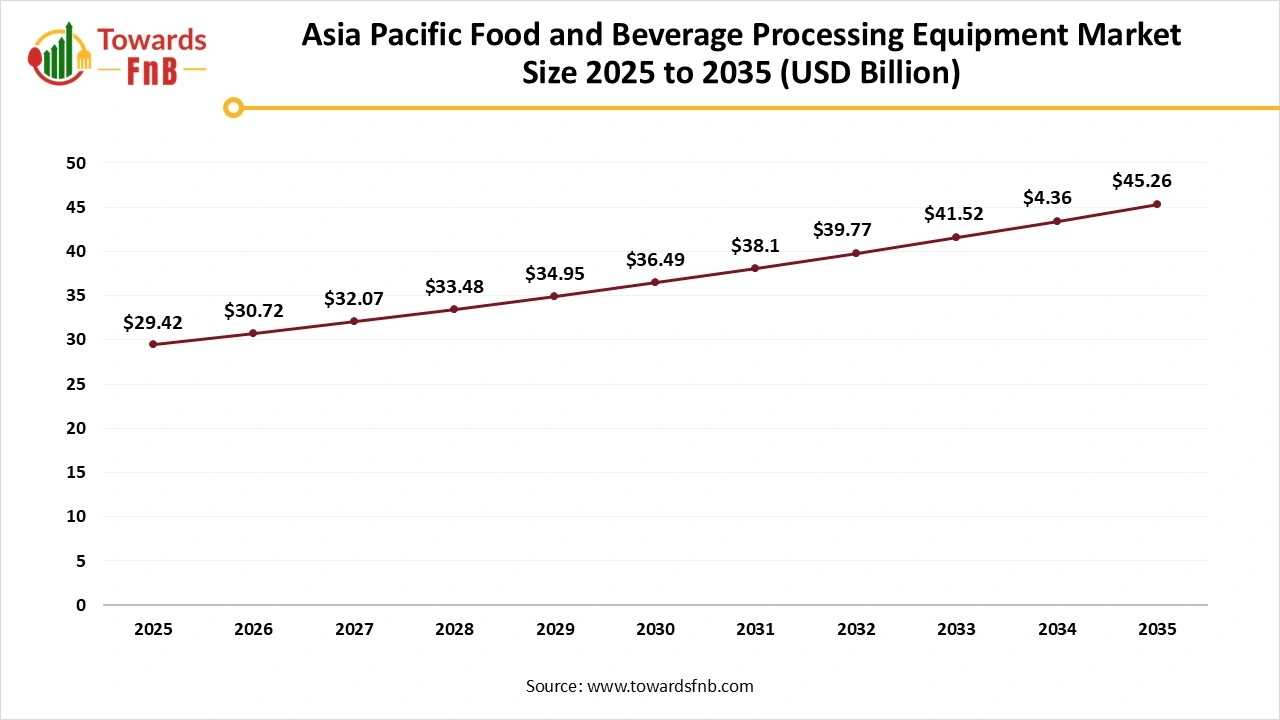

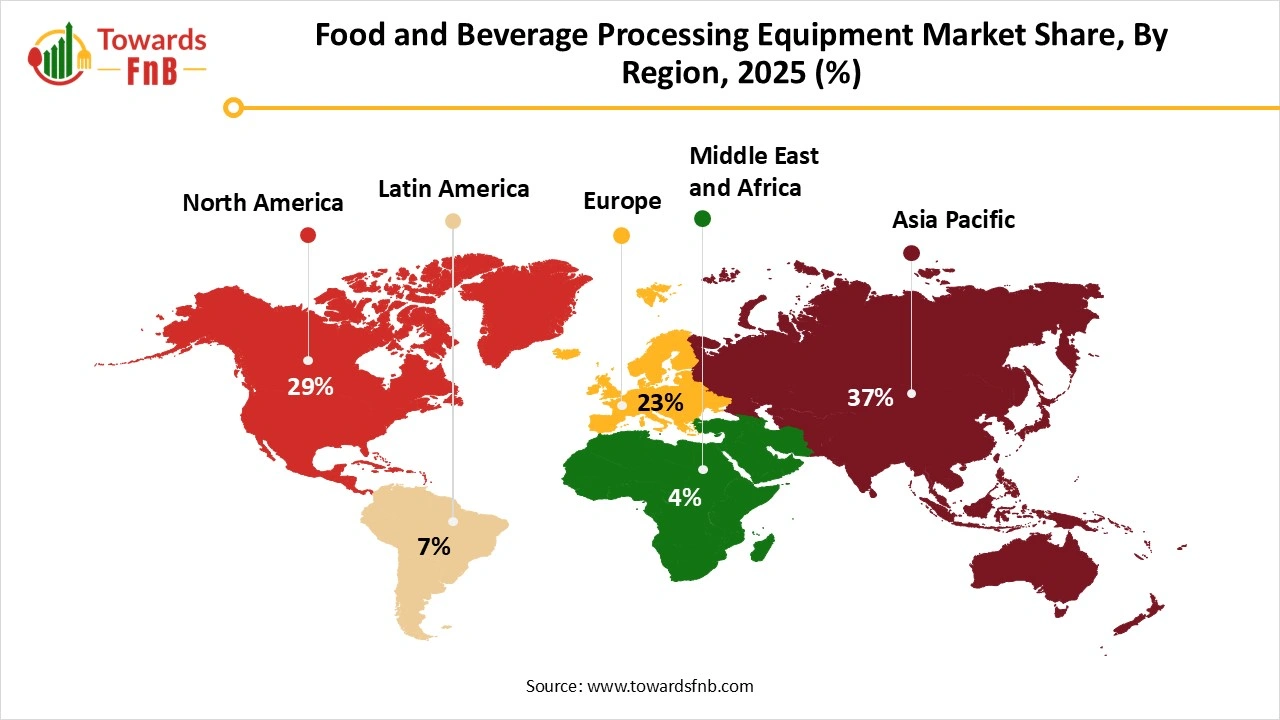

- By region, Asia Pacific led the food and beverage processing equipment market with largest share of 37% in 2025, whereas North America is observed to be the fastest-growing region in the forecast period.

- By type, the pre-processing segment led the food and beverage processing equipment market in 2025, whereas the processing segment is expected to grow in the foreseen period.

- By application, the bakery and confectionery products segment led the food and beverage processing equipment market in 2025, whereas the non-alcoholic beverages segment is observed to be the fastest growing in the foreseen period.

- By end product form, the solid segment led the food and beverage processing equipment market in 2025, whereas the liquid product segment is expected to grow in the foreseen period.

- By mode of operation, the automatic segment led the food and beverage processing equipment market in 2025, whereas the semi-automatic segment is expected to grow in the foreseen period.

“Food and beverage processors are no longer investing in automation purely for efficiency, it has become a strategic necessity to ensure food safety, supply continuity, and margin stability,” said Vidyesh Swar, Principal Consultant at Towards FnB.

“AI-enabled processing and predictive maintenance are redefining how manufacturers manage risk, reduce downtime, and respond to evolving consumer demand.”

Higher Food Safety Standards Are Helpful for the Growth of the Food and Beverage Processing Equipment Industry

The food and beverage processing equipment market is expected to grow significantly due to higher demand for processed and convenient food options, along with higher demand for safety and hygiene, which is helpful for the growth of the market. Higher demand for processed and convenience food options by consumers with a hectic lifestyle also fuels the growth of the market. Changing consumer lifestyles leading to shifting preferences is another major factor for the growth of the market.

Impact of AI in the Food and Beverage Processing Equipment Market

Artificial intelligence is increasingly embedded in food and beverage processing equipment to improve operational efficiency, product consistency, and asset reliability across large-scale manufacturing environments. Machine learning models are used to analyze real-time sensor data from mixing, heating, cooling, filling, and packaging systems to optimize parameters such as temperature control, flow rates, pressure, and residence time, which directly influence yield, texture, and microbiological safety. AI-enabled vision systems are widely deployed for in-line inspection to detect fill-level deviations, seal integrity issues, foreign matter, and labeling errors at high line speeds, reducing waste and rework. Predictive maintenance applications use AI to monitor vibration patterns, motor load, and thermal signatures in critical equipment such as pasteurizers, homogenizers, separators, and fillers, allowing manufacturers to anticipate failures and schedule maintenance before unplanned downtime occurs.

AI also supports adaptive process control by learning from historical batch outcomes and automatically adjusting setpoints to accommodate raw material variability and changing throughput demands. From a compliance and safety perspective, AI-assisted traceability and process validation tools link equipment data with sanitation cycles, allergen changeovers, and critical control points, supporting food safety systems aligned with guidance from the Food and Agriculture Organization and regulatory frameworks enforced by the U.S. Food and Drug Administration. AI acts as an efficiency and risk-management layer in the food and beverage processing equipment market, enabling manufacturers to operate complex, high-speed production lines with greater consistency, lower operating costs, and improved regulatory confidence.

Recent Developments in Food and Beverage Processing Equipment Market

- In May 2025, top food manufacturing companies of Europe—Alfa Laval, Krones, SPX FLOW, and Tetra Pak—announced the launch of their alliance called Food Manufacturing Technologies Europe (FMTE). The main aim of the alliance is to share its commitment to address the major issues faced by the industry.

- In November 2025, Tetra Pak unveiled its next-generation Automation and Digitalization (A&D) portfolio named Tetra Pak Factory OS. The unveiling was done at Gulfood Manufacturing in Dubai.

Technologies Aiding the Growth of the Food and Beverage Processing Equipment Market

- Industry 4.0 and Digitalization- The segment involves the use of IoT, sensors, AI, and ML for data-driven analysis, predictive maintenance, and optimized operations for enhanced product quality.

- Automation and Robotics- Enhanced controlled systems and the use of robotics also help to enhance the market’s growth by lowering human intervention and enhancing the safety and hygiene levels, which also helps to fuel the food and beverage processing equipment market growth.

-

Smart Equipment—Use of smart equipment enabled with advanced features is one of the major factors for the growth of the market. It helps to provide real-time monitoring and efficient tracking and allows for quick adaptation.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/food-and-beverage-processing-equipment-market

New Trends of Food and Beverage Processing Equipment Market

- Technological advancements helpful in the production process help to fuel the growth of the market.

- Higher demand for protein-rich, gluten-free, low-sugar, and healthier options also helps to fuel the growth of the market.

- Equipment designed to use lower energy and fuel, along with reduced waste, is another major factor for the growth of the food and beverage processing equipment market.

Product Survey of the Food and Beverage Processing Equipment Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Mixing and Blending Equipment | Combines raw ingredients uniformly to achieve consistent formulations | Ribbon blenders, paddle mixers, high-shear mixers | Food manufacturers, beverage processors | Industrial food mixers and blenders |

| Size Reduction Equipment | Reduces particle size for texture control and process efficiency | Grinders, mills, crushers, pulverizers | Spice processors, cereal and snack producers | Food grinding and milling systems |

| Thermal Processing Equipment | Applies controlled heat for cooking, pasteurization, or sterilization | Batch cookers, pasteurizers, retorts, UHT systems | Beverage companies, ready-meal manufacturers | Thermal food processing lines |

| Separation Equipment | Separates solids and liquids or different phases | Centrifuges, separators, filtration systems | Dairy processors, beverage manufacturers | Industrial food separators |

| Extrusion Equipment | Shapes and cooks food materials under heat and pressure | Single-screw and twin-screw extruders | Snack producers, breakfast cereal manufacturers | Food extrusion systems |

| Forming and Shaping Equipment | Shapes food products into uniform sizes and formats | Molders, formers, patty machines | Meat processors, bakery manufacturers | Food forming machinery |

| Filling and Dosing Machines | Accurately fills liquids, semi-solids, or solids into containers | Volumetric fillers, piston fillers, auger fillers | Beverage bottlers, packaged food producers | Filling and dosing equipment |

| Drying and Dehydration Equipment | Removes moisture to extend shelf life and reduce weight | Spray dryers, fluidized bed dryers, tray dryers | Ingredient manufacturers, dairy processors | Industrial food drying systems |

| Cooling and Freezing Equipment | Rapidly lowers product temperature to preserve quality | Blast freezers, spiral freezers, cooling tunnels | Frozen food manufacturers, meat processors | Industrial freezing systems |

| Packaging Equipment | Packages finished products for storage and distribution | Flow wrappers, bottling lines, cartoners | Food and beverage manufacturers | Food and beverage packaging lines |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5974

Food and Beverage Processing Equipment Market Dynamics

What Are the Growth Drivers of the Food and Beverage Processing Equipment Market?

Factors such as higher demand for processed food options, advanced technological features, and higher demand for convenient and sustainable options are some of the major factors for the growth of the market. Growing demand for processed food options is helpful for consumers with a hectic lifestyle, as it helps to save their time and energy. Technological advancements in the form of AI, IoT, automation, robotics, and other similar features also help to fuel the growth of the market due to ease of production in the case of high-volume packaging. Stringent food safety regulations to maintain food safety and ensure hygiene are another major factor helpful for the growth of the market.

High Capital Investment Is Obstructing the Growth of the Market

One of the major restraints in the growth of the food and beverages processing equipment market is high capital investment. Higher costs required for setting up technologically advanced machinery, along with the costs required for its timely maintenance, may obstruct the growth of the market. Hence, small and medium-sized enterprises step back and continue with traditional machinery that is cost-effective, further hampering the growth of the food and beverage processing equipment market.

Smart Technology Is Helpful for the Growth of the Food and Beverage Processing Equipment Market

Technological advancements helpful to elevate the product quality and enhance the production process are one of the major opportunities for the growth of the market. AI-driven diagnostics, sensors, and automated systems help to lower human intervention, improve product traceability, and also help to manage production costs efficiently, further enhancing the growth of the food and beverage processing equipment market. Such advanced features also help to maintain sustainability, along with maintaining food safety, which is highly essential for the food and beverages domain.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Food and Beverage Processing Equipment Market Regional Analysis

Asia Pacific Dominated the Food and Beverage Processing Equipment Market in 2025

Asia Pacific led the food and beverage processing equipment market in 2025, due to factors such as the growing population of the region, rising disposable incomes, and higher demand for processed food and beverage options requiring minimal preparation time. Such options are highly demanded by consumers with a hectic lifestyle to manage their time and consume nourishing food choices as well. Higher demand for automation in the region for lowered human intervention and elevated food safety also helps to fuel the growth of the market. Countries such as India, China, Japan, and South Korea have a major impact on the growth of the market due to higher demand for packaged and processed options.

North America Is Observed to Be the Fastest-Growing Region in the Foreseen Period

North America is observed to be the fastest-growing region in the foreseen period due to higher demand for automation and accuracy in the processing procedures, fueling the growth of the market. Higher demand for processed and convenient food options by consumers with a hectic lifestyle is another major factor for the food and beverage processing equipment market growth. Adoption of technologies such as Industry 4.0, controlled systems, along with strict regulatory requirements, also helps to elevate the market’s growth in the foreseen period. The US has made a major contribution to the growth of the market due to higher demand for domains such as dairy, processed options, and packaged food, along with higher demand for automation.

Europe Is Observed to Have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period, mainly due to changing and supportive EU policies helpful to elevate the growth of the food and beverage processing equipment market. Higher demand for automation along with various technological features for a flawless final product and an enhanced production process for high-volume production is another major factor for the growth of the market. Germany has made a major contribution to the growth of the market due to its tightened grip on food engineering along with rigorous food and safety regulations laid out by entities such as the Federal Ministry of Food and Agriculture.

Trade Analysis for the Food and Beverage Processing Equipment Market

What Is Actually Traded (Product Forms and HS Proxies)

- Food and beverage processing machinery, including mixers, grinders, separators, pasteurizers, and thermal processing systems, is commonly declared under HS 8438 (machinery for the industrial preparation of food or drink).

- Beverage-specific processing equipment, such as brewhouses, juice extractors, carbonation systems, and filling-preparation units, is typically classified under HS 8438 depending on function.

- Dairy processing equipment, including homogenizers, pasteurizers, and cheese-making machinery, is generally traded under HS 8434 and HS 8438 depending on specialization.

- Meat, poultry, and seafood processing machinery, such as cutters, deboners, tumblers, and portioning systems, is commonly cleared under HS 8438.

-

Integrated processing and packaging lines, where preparation equipment is supplied with filling or sealing modules, may include components classified under HS 8422 (packing or wrapping machinery).

Top Exporters (Supply Hubs)

- Germany: Leading exporter of high-precision food and beverage processing equipment, supported by advanced mechanical engineering, automation, and compliance with global hygiene standards.

- Italy: Major exporter of modular and application-specific food processing machinery, particularly for bakery, dairy, and beverage processing.

- China: Large-volume exporter of cost-competitive food and beverage processing equipment for small and mid-scale processors.

- United States: Exporter of branded processing systems and turnkey solutions for large-scale food and beverage manufacturers.

Top Importers (Demand Centres)

- United States: Significant importer driven by plant modernization, capacity expansion, and replacement demand across food and beverage categories.

- European Union: Strong intra-EU and extra-EU imports reflecting continuous upgrading of food and beverage processing facilities.

- China: Imports advanced and specialized processing equipment not produced domestically at equivalent technical levels.

- Middle East: High import demand linked to food security initiatives, beverage production localization, and reliance on imported capital equipment.

Typical Trade Flows and Logistics Patterns

- Complete processing lines are shipped via containerized sea freight or break-bulk transport due to size and weight.

- Large systems are delivered in multiple consignments and assembled on-site by supplier engineers.

- High-value components and spare parts are frequently shipped by air to minimize production downtime.

- Regional service hubs support installation, commissioning, maintenance, and operator training.

Trade Drivers and Structural Factors

- Growth in processed food and beverage consumption sustains investment in processing capacity.

- Automation and labor efficiency requirements drive adoption of advanced processing systems.

- Food safety and hygiene compliance necessitate replacement of legacy equipment.

- Product diversification and shorter innovation cycles increase demand for flexible machinery.

- Capacity localization strategies reduce reliance on imported finished foods and beverages.

Regulatory, Quality, and Market-Access Considerations

- Equipment must comply with machinery safety, electrical standards, and food contact material regulations.

- Hygienic design, cleanability, and traceability influence acceptance in regulated markets.

- Certification, conformity assessment, and technical documentation are required prior to import and installation.

- Local inspection, licensing, and operator certification can affect commissioning timelines.

Government Initiatives and Public-Policy Influences

- Food processing modernization programs and industrial incentives indirectly stimulate equipment demand.

- Food safety regulations drive upgrading of processing infrastructure.

- Trade facilitation policies and capital equipment tariff frameworks affect cross-border machinery flows.

Food and Beverage Processing Equipment Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 4.4% |

| Market Size in 2026 | USD 83.02 Billion |

| Market Size in 2027 | USD 86.67 Billion |

| Market Size in 2030 | USD 98.62 Billion |

| Market Size by 2035 | USD 122.32 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Food and Beverage Processing Equipment Market Segmental Analysis

Type Analysis

The pre-processing segment led the market in 2025, due to its higher demand by the ready-to-cook and clean-label food industries. Higher demand by industries with strict hygiene regulations also helps to fuel the growth of the market. The industry also observes growth as automation aids various preprocessing activities, such as peeling, washing, sorting, and waste management. It helps to lower the chances of human error and maintain efficiency, further fueling the growth of the market.

The processing segment is observed to be the fastest-growing in the foreseen period as it forms the foundation of the food and beverage manufacturing industries. The segment also emphasizes the importance of automation, which is helpful to lower human errors along with maintaining efficiency, further fueling the growth of the market. The segment also observes growth as it signifies various other activities such as cooking, blending, and fermentation. Higher demand for automation and cutting-edge technology is another major factor for the growth of the food and beverage processing equipment market.

Application Analysis

The bakery and confectionery segment led the food and beverage processing equipment market in 2025, due to higher demand for bakery goods globally. A few bakery items, such as breads, rusks, and cookies, form the staple diet of consumers, further enhancing the growth of the market. Higher demand for healthier options enriched with essential nutrients and fortified ingredients also helps to fuel the segment’s growth.

The non-alcoholic drinks segment is expected to grow in the foreseen period due to the growing health-conscious population, leading to higher demand for healthier options. Increasing automation and technology in the food and beverage processing equipment market also help to fuel its growth in the foreseeable period. Hence, such factors also lead to higher demand for flavored water, fruit juice, and plant-derived drinks.

End Product Form Analysis

The solid segment led the food and beverage processing equipment market in 2025, as it is easy to manage solid food options, further fueling the growth of the market. The market also observes growth as solid items are easy to pack and transport, compared to liquid and semi-solid options. Hence, such factors altogether help to fuel the growth of the market.

The liquid segment is observed to grow in the foreseen period, as its manufacturing involves various physical and chemical procedures involving tools such as crushing and pressing machinery, tanks and fermenters, temperature regulation devices, filtration systems, and more. Higher demand for functional, organic, and healthier choices by health-conscious consumers also helps to fuel the market’s growth in the foreseen period. Higher demand for safety and hygiene also helps to hike the market’s growth.

Mode of Operation Analysis

The automatic segment dominated the food and beverage processing equipment market in 2025, due to rising demand for ready-to-eat foods, convenient foods, and processed options by consumers. The changing lifestyle of consumers, paired with a hectic schedule, leads to higher demand for automation, which is helpful for the growth of the market. Automation helps to enhance production efficiency along with a flawless final product, which is one of the major factors for the growth of the market.

The semi-automatic segment is expected to grow in the foreseen period, mainly due to its affordability factor, allowing small and medium-sized enterprises to further fuel the growth of the market. The market also observes growth due to limited capital requirements and lower energy consumption. Such factors altogether help to fuel the growth of the market in the foreseen period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Key Market Leaders and Their Strategic Role in Advancing Food and Beverage Processing Equipment Market

- Alfa Laval (Sweden): Alfa Laval is a global leader in heat transfer, separation, and fluid handling technologies for the food and beverage industry, supplying critical equipment such as heat exchangers, separators, and hygienic flow components. Strategically, the company plays a vital role in improving food safety, energy efficiency, and sustainability across dairy, beverage, and liquid food processing facilities, making it a preferred partner for large-scale plant modernization and ESG-driven investments.

- Bucher Industries AG (Switzerland): Bucher Industries AG, through its food and beverage divisions, specializes in juice extraction, beverage processing, and food handling solutions, with strong expertise in fruit, vegetable, and wine processing. Its strategic importance lies in enabling high yield recovery, premium product quality, and minimal processing losses, positioning the company to benefit from rising demand for clean-label, plant-based, and natural beverage products.

- SPX Flow Inc. (United States): SPX Flow Inc. delivers advanced processing solutions including mixers, pumps, homogenizers, and thermal systems for food, beverage, and dairy manufacturers. The company’s strategic impact stems from its ability to provide flexible, modular, and hygienically designed systems that support regulatory compliance and automation upgrades, making it a key supplier for processors transitioning from legacy equipment to smart manufacturing environments.

- The Middleby Corporation (United States): The Middleby Corporation is widely recognized for its commercial cooking and foodservice equipment while increasingly expanding into industrial food processing and protein automation solutions. Strategically, Middleby bridges foodservice and industrial processing, benefiting from growth in ready-to-eat foods, centralized kitchens, and quick-service restaurant supply chains that demand speed, consistency, and automated production.

- Krones AG (Germany): Krones AG is a global leader in beverage processing, filling, bottling, and packaging systems, offering end-to-end turnkey solutions for liquid food and beverage manufacturers. Its strategic impact is defined by its dominance in fully integrated production lines, digital factory solutions, and sustainability-focused technologies, positioning Krones as a critical infrastructure provider for the rapidly expanding non-alcoholic and packaged beverage segments.

- Tetra Laval Group: The Tetra Laval Group, primarily through Tetra Pak, provides comprehensive processing, packaging, and automation solutions for dairy and liquid food producers worldwide. Strategically, the group shapes global food processing standards through aseptic technology, digital factory platforms, and lifecycle services, enabling long shelf life, food safety, and supply chain resilience especially in emerging and high-growth markets.

- Marel: Marel delivers advanced processing solutions for meat, poultry, seafood, and alternative protein industries by combining equipment with AI-driven software and vision systems. Its strategic impact lies in yield optimization, waste reduction, and labor efficiency, making Marel a critical technology partner as protein processors shift toward automation, data-driven decision-making, and sustainable production models.

- GEA Group: GEA Group supplies a broad range of processing, refrigeration, separation, and automation solutions across dairy, beverage, bakery, and prepared food applications. Strategically, GEA’s strength lies in large-scale, energy-efficient systems that support decarbonization and regulatory compliance, positioning the company as a key beneficiary of global plant modernization and sustainability initiatives.

-

Bühler: Bühler is a global leader in grain milling, flour processing, chocolate, coffee, and plant-based food technologies, serving as a backbone supplier to staple and specialty food production worldwide. Its strategic importance is rooted in food security, innovation in plant-based proteins, and deep R&D capabilities, enabling Bühler to influence long-term processing standards and sustainable nutrition strategies.

Segments Covered in the Report

By Type

- Pre-processing

- Sorting & grading

- Cutting, peeling, grinding, slicing, and washing

- Mixing & blending

- Processing

- Forming

- Extruding

- Coating

- Drying, cooling, and freezing

- Thermal

- Homogenization

- Filtration

- Pressing

By Application

- Bakery & confectionery products

- Meat & poultry

- Dairy products

- Fish & seafood

- Alcoholic beverages

- Non-alcoholic beverages

- Other applications

By End Product form

- Solid

- Liquid

- Semi-solid

By Mode of Operation

- Semi-automatic

- Automatic

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5974

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.