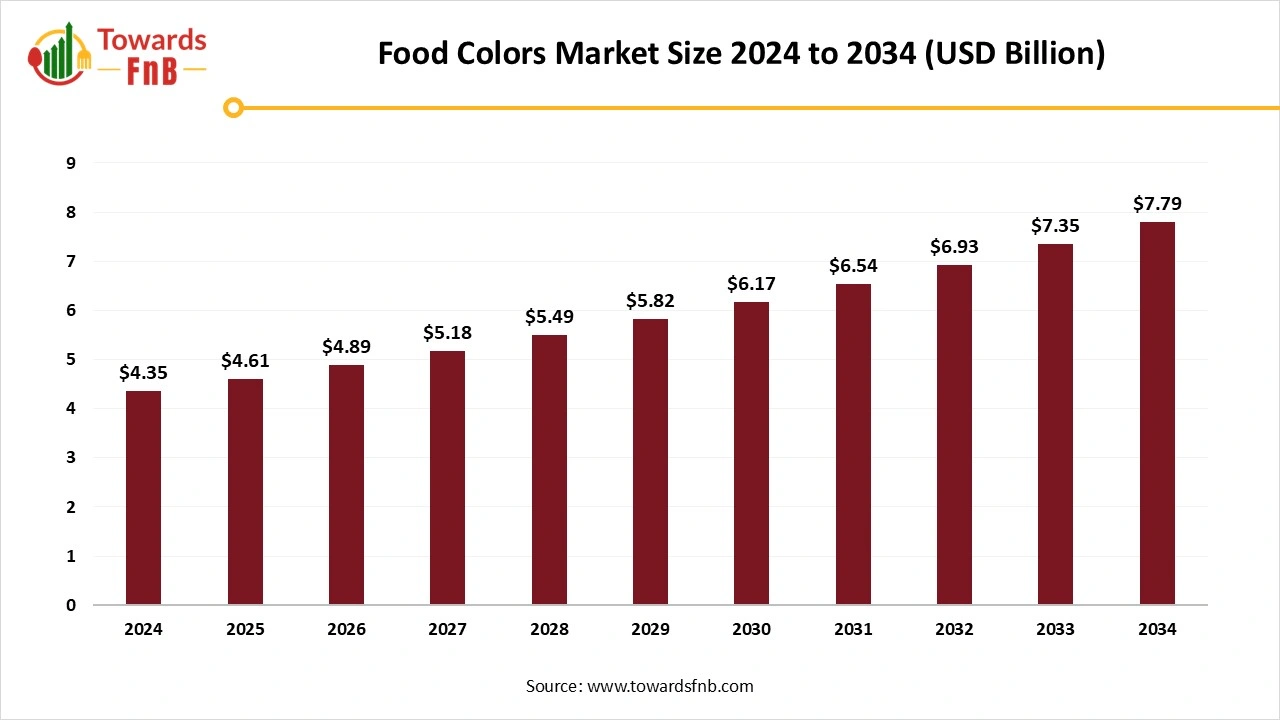

Food Colors Market Size to Exceed USD 7.79 Billion by 2034 Amid Surge in Natural and Plant-Based Pigments | Towards FnB

According to Towards FnB, the global food colors market size is calculated at USD 4.61 billion in 2025 and is expected to hit USD 7.79 billion by 2034. This steady expansion reflecting a CAGR of 6% from 2025 to 2034 shows how rapidly the industry is evolving as brands prioritize vibrant product aesthetics, natural pigment alternatives, and cleaner-label formulations to meet modern consumer expectations.

Ottawa, Nov. 20, 2025 (GLOBE NEWSWIRE) -- The global food colors market size stood at USD 4.35 billion in 2024 and is anticipated to increase from USD 4.61 billion in 2025 to reach nearly USD 7.79 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market has experienced a surge in recent periods due to factors such as high demand for visually appealing foods and beverages, increased demand for convenient food items, and rising demand for bakery, confectionery, sweet, and flavorful snacks. Higher demand for natural and clean-label ingredients is another major factor for the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5917

Key Highlights of the Food Colors Market

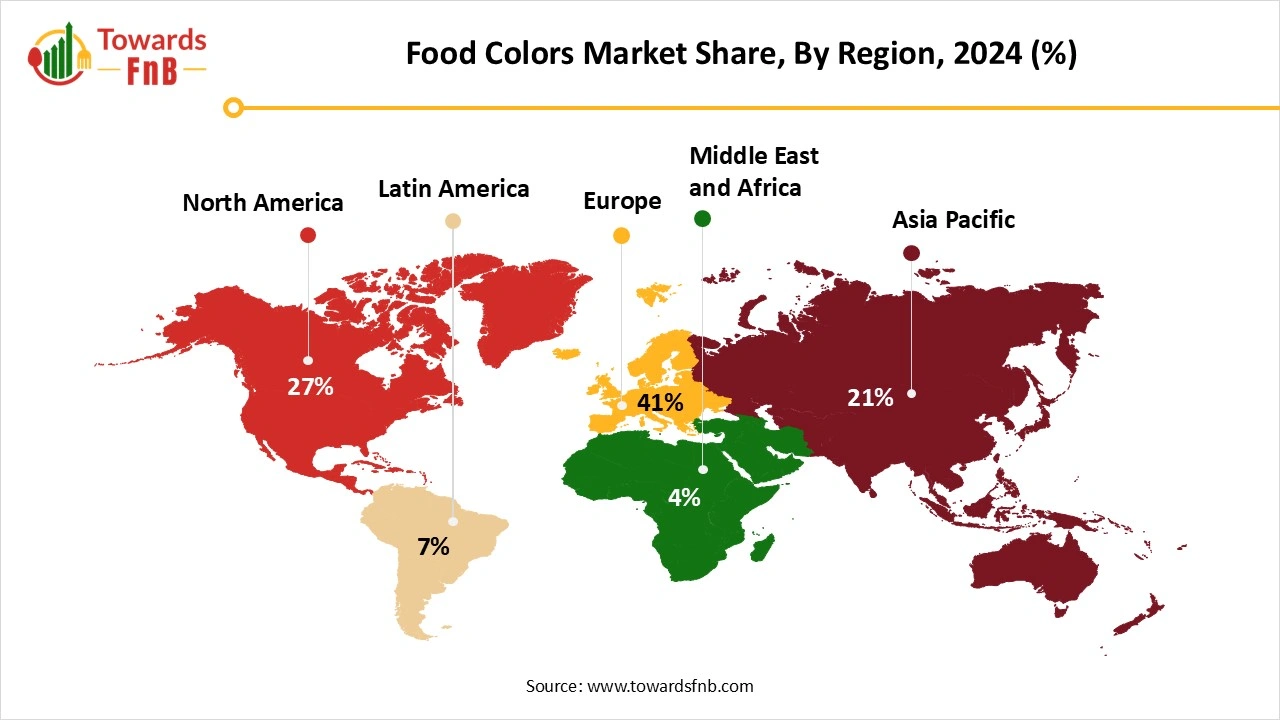

- By region, Europe led the global food colors market with a dominant share of 41% in 2024, while the Asia Pacific region is expected to experience notable growth, with a CAGR of 7.5% between 2025 and 2034.

- By type, the natural colors segment held a commanding share of 76.5% in 2024, while the synthetic colors segment is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- By form, the liquid form segment accounted for the largest share of 71.5% in 2024, with the dry (powder) form segment expected to expand at a significant CAGR of 6.5% over the forecast period from 2025 to 2034.

- By solubility, water-soluble colors dominated the market with a 74.3% share in 2024, while the oil-dispersible segment is anticipated to grow at a solid CAGR of 6.7% during the projected period.

- By application, the beverages segment held the largest market share of 42.3% in 2024, while the bakery and confectionery segment is expected to see robust growth with a CAGR of 6.6% between 2025 and 2034.

Food and beverage brands are under simultaneous pressure from consumers and regulators: shoppers are actively avoiding ‘artificial’ labels, while authorities are tightening oversight on synthetic dyes,” said Vidyesh Swar, Principal Consultant at Towards FnB. “This is creating a structural shift toward natural, traceable, and functional color solutions that not only deliver visual impact but also support health and sustainability narratives.

Technological Advancements Fueling the Food Colors Industry

The food colors market is observed to grow due to high demand for visually appealing food and beverages options. Along with the higher demand for natural, organic, and clean-label product options. Technological advancements are helping the industry to find innovative and safe methods for the extraction of food color options that are safe, natural, and organic, to maintain the nutritional value of various food options. Technologically advanced methods such as microencapsulation, extraction technologies, customization, and the use of plant-based and organic sources help to enhance the use of natural food colorants and lower the usage of synthetic and chemical-based food dyes.

Major Companies of the Food Colors Market

- POET LLC- POET is a major US brand involved in the manufacturing of various product options, including bioethanol, high-protein animal feed, purified alcohol, and corn oil. The company is also involved in the manufacturing of natural food colors to elevate the food and beverage industry.

- Archer Daniels Midland Company- the company has a huge product portfolio involving the manufacturing of bioethanol and biodiesel. The main aim of the company is to lower its carbon footprint to do its bit for the environment.

-

Nestle Corporation- the brand has a huge product portfolio involving the manufacturing of different types of products, along with the manufacturing of products such as renewable diesel and sustainable aviation fuel for transportation and industrial applications.

New Trends in the Food Colors Market

- Higher demand for natural, organic, and recognizable products, leading to higher demand for natural colors, is one of the major factors for the growth of the market.

- Higher demand for plant-based and microorganism-based natural food color options is another major factor for the market’s growth due to their multiple health benefits.

- Product innovation for the manufacturing of natural colors that help to enhance the food quality and standards is another major factor for the growth of the market.

Impact of AI on the Food Colors Market

Artificial intelligence is influencing the food colors market by improving formulation accuracy, product safety, and manufacturing efficiency. In research and development, AI-powered algorithms analyze ingredient interactions, stability profiles, and regional taste preferences to help manufacturers create natural and synthetic colors with better vibrancy, heat resistance, and shelf life. Machine learning models simulate how food colors behave across different pH levels, processing conditions, and food matrices, reducing trial-and-error and accelerating the development of clean-label, plant-based coloring alternatives.

AI-driven predictive analytics optimize extraction, blending, and drying processes, especially for natural pigments such as carotenoids, anthocyanins, and chlorophylls. Computer vision systems monitor color uniformity, detect impurities, and ensure batch consistency in real time, strengthening quality control. AI also enhances sustainability by identifying ways to reduce water, solvent use, and energy consumption during pigment extraction and processing.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/food-colors-market

Recent Developments in Food Colors Market

- In November 2025, PepsiCo announced the reinvention of two of its popular snacks- Doritos and Cheetos. The brand will launch simply NKD Doritos and Cheetos products in their original flavors, which will be free of bright artificial dyes. (Source- https://food.ndtv.com)

- In November 2025, Oterra, a global supplier of natural colors for the food and beverage industry, partnered with Swiss innovator Seprify to bring a plant-based white coloring to the market. The plant-based color will be an ideal replacement for titanium dioxide (TiO2) (Source- https://chemindigest.com)

Trade Analysis of the Food Colors Market

Import & Export Statistics

Global exporter leadership (value signals)

- China, the Netherlands, and the United States are among the largest exporters of colouring matter by value in 2023, illustrating both commodity- and higher-value supply bases. In 2023, China exported around USD 260 million, the Netherlands about USD 200 million, and the United States about USD 173 million under the broader vegetable/animal dyes grouping. These exporters supply a mix of natural extracts, synthetic pigments, and processed preparations used by food, beverage, and cosmetics manufacturers.

Representative country snapshots

- India reported exports of colouring matter of vegetable or animal origin of about USD 26.31 million in 2023, with documented partner shipments to markets such as Nigeria, Bangladesh, and the United States that year. This highlights India’s role as both a raw-material supplier and a regional processor of natural food colours.

Shipment vs value dynamics and form factors

- Trade records show two distinct trade patterns: (a) high-value, low-volume shipments of refined colour extracts and standardised curcuminoid or carmine preparations destined for food and nutraceutical formulators, and (b) higher-volume commodity shipments of basic colouring matter and intermediates used in industrial food processing. Customs tonnage and value data typically place refined preparations at much higher unit values than crude plant extracts. Use HS subheading detail and customs product descriptions to separate these flows.

Importer profiles and demand hubs

- Major import markets for food colours include large food-processing and beverage markets in the European Union, the United States, Japan, and parts of East and Southeast Asia. Import demand is strongest where high levels of processed food manufacturing and strict food safety regulation drive demand for certified, traceable colouring ingredients. National import tables for HS 3203 show these markets as regular top importers by value and quantity.

Regulatory, certification, and market access effects on trade

Trade in food colours is shaped by food-contact regulations, additive approvals, and labelling rules in major markets. Exporters supplying the EU, US, or Japan must provide certificates of analysis, safety dossiers, and traceability evidence to secure market access. Differences in allowed colourants and maximum use levels across jurisdictions can channel trade toward suppliers able to demonstrate compliance documentation rapidly.

Product Survey of the Food Colors Market

| Product Category | Description / Function | Common Forms / Variants | Key Applications / End-Use Sectors | Representative Producers / Brands |

| Natural Food Colors | Colors extracted from botanical, animal, or mineral sources used for clean-label products. | Beet red, turmeric yellow, spirulina blue, paprika oleoresin, chlorophyll, annatto | Dairy, bakery, beverages, confectionery, snacks | Givaudan (Naturex), Sensient Natural Colors, Döhler, ADM |

| Synthetic Food Colors | Lab-produced FD&C and EU-approved colorants offering strong stability and vibrancy. | Tartrazine, sunset yellow, allura red, brilliant blue, ponceau 4R | Confectionery, beverages, processed foods, pharmaceuticals | Sensient Technologies, Roha, Kalsec, DSM-Firmenich |

| Lake Colors | Water-insoluble forms of synthetic dyes fixed onto substrates for high stability in fat-rich or dry systems. | Lake red, lake yellow, lake blue | Snacks, coatings, chocolates, seasonings | Roha, Sensient, Cathay Industries |

| Oil-Soluble Colors | Colorants dispersed in oil for use in lipid-based food matrices. | Beta carotene oil, turmeric oil, paprika oil | Oils, margarines, dressings, processed cheese | Kalsec, DDW (Givaudan), Danisco |

| Water Soluble Colors | Dissolvable colorants suitable for high clarity beverages and frosting. | Anthocyanins, caramel, synthetic solubles | Soft drinks, syrups, dairy beverages | DSM-Firmenich, Döhler, ADM |

| Caramel Colors | One of the most widely used browns produced through controlled heat treatment of sugar. | Class I (plain), Class II (caustic), Class III (ammonia), Class IV (sulfite ammonia) | Soft drinks, beer, sauces, bakery | Sethness Roquette, D.D. Williamson (DDW), Ingredion |

| Fruit and Vegetable-Based Colors | Minimal processing colors derived entirely from fruits or vegetables for clean-label claims. | Purple carrot, blackcurrant, red radish, elderberry | Baby food, smoothies, natural confectionery | GNT Group (Exberry), Oterra |

| Powdered Food Colors | Stable dry color formats suitable for dry mixes and bakery. | Natural powders, synthetic powders, encapsulated powders | Bakery mixes, seasonings, snacks | Sensient, Roha, Kalsec |

| Liquid Food Colors | Liquid concentrates are used for precise dosing in industrial production. | Water-soluble liquids, oil-soluble liquids | Beverages, ice cream, and sauces | ADM, Kalsec, Döhler |

| Encapsulated Colors | Protected pigments are designed for improved heat, light, and oxidation stability. | Encapsulated turmeric, beta carotene, and anthocyanins | High temperature baking, extrusion, fortified foods | Givaudan, Sensient, Oterra |

| Functional Color Ingredients | Colors with added health benefits or functional properties. | Curcumin (antioxidant), spirulina (protein pigment) | Functional beverages, nutritional bars, gummies | Nutraceutical ingredient suppliers, natural color specialists |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5917

Food Colors Market Dynamics

What are the Growth Drivers of Food Colors Market?

The growing population of health-conscious consumers, leading to higher demand for natural and organic food color options, is a major factor driving market growth. Such food colors help make different food and beverage options more appealing, enhance their quality and shelf life, and support market growth. Higher demand for clean-label and functional food options also helps drive market growth. Developing technologies such as microencapsulation and extraction to improve stability and enhance the visual appeal of various food options is another major factor driving market growth.

Challenge

Regulatory Issues May Hamper the Growth of the Market

Regulatory issues, including strict government regulations that vary by region, costs involved in the entire procedure, and other similar factors, may restrict the market’s growth. A few countries have a ban on the use of synthetic food colors, along with a huge protocol list to be followed for using any form of food dyes in the manufacturing of various food options. Hence, such factors, when compiled together, may hamper the growth of the food colors market.

Opportunity

Higher Demand for Natural Options Is Helpful for the Growth of the Food Colors Industry

The growing population's interest in health and nutrition, leading to higher demand for organic, natural, fortified, and clean-label products, is a major opportunity for market growth. Such food dyes help enhance the visual appeal of food and beverages, as well as their quality. They help make different food items more appealing and enhance their sales, such as sweets, bakery and confectionery, seafood, and various beverage options. Hence, such factors help enhance market growth in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Food Colors Market Regional Analysis

Europe Dominated the Food Colors Market in 2024

Europe dominated the food colors market in 2024 due to high demand for natural, organic, and clean-label options. Consumers in the region are increasingly seeking natural food dyes made from safe sources, driven by the growing population of health-conscious consumers. The strict EU regulations on the use of food colors across various food products are another major factor driving market growth in the region.

Hence, consumers in the region prefer natural food dyes over synthetic alternatives to maintain their nutritional health profile. Germany has a major contribution to the growth of the regional market due to higher demand for food options such as bakery and confectionery, dairy products, seafood, and other vibrant, appealing options. Higher consumer demand for natural and organic colors in the region for the production of various food and beverage items also fuels the growth of the food colors market.

Asia Pacific is Observed to Be the Fastest-Growing Region in the Foreseeable Period

Asia Pacific is expected to grow in the foreseen period due to high demand for organic and natural food colorants to enhance the appearance of food and beverages. The growing demand for various food options, such as convenient, ready-to-eat, bakery and confectionery, seafood, and sweet options, also fuels market growth. India has made a major contribution to the market's growth due to high demand for natural and organic color options to maintain a nutritional profile and avoid damage caused by excessive use of synthetic colors.

North America is Observed to Have Notable Growth in the Foreseeable Period

North America is expected to see notable growth over the forecast period due to high demand for organic and natural food colors. Government regulation of the region regarding the overuse of petroleum-derived synthetic colors is another major factor driving market growth. Hence, these factors further fuel the market's growth in the region. The US has a major contribution to the growth of the regional market due to high demand for natural and organic food color options, driven by the growing population of health-conscious consumers who demand the elimination of synthetic colors.

Food Colors Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Market Size in 2025 | USD 4.61 Billion |

| Market Size in 2026 | USD 4.89 Billion |

| Market Size by 2034 | USD 7.79 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Food Colors Market Segmental Analysis

Type Analysis

The natural colors segment dominated the food colors market in 2024, driven by higher demand for organic, natural, and clean-label options to maintain nutritional profiles. The segment is also growing as more health-conscious people demand aesthetically appealing food options that are healthier. Technological advancements, such as microencapsulation and precision fermentation, are cost-effective and stable methods for using natural food colors, which are further helpful for market growth. Higher risk factors associated with the use of synthetic colors are another major factor driving market growth.

The synthetic colors segment is expected to grow over the forecast period due to factors such as affordability, availability, higher usage in large quantities, and their ability to make foods visually bright and appealing. Such colors are cost-effective and are hence the prime choice for food manufacturers operating on a large scale. They help enhance stability and storage environments, which further support market growth.

Form Analysis

The liquid form segment dominated the food colors market in 2024 due to the ease of blending liquid colors into various food options to make them visually appealing and enhance the food quality. Such food colors also help enhance the shelf life of food and beverage products and are widely used by the food manufacturing industry to produce sauces, dips, and dairy products with the desired hues and consistency. Higher demand for convenience and customization is another major factor driving market growth.

The dry form segment is expected to be the fastest-growing segment over the forecast period due to its advantages, such as easy storage, transportability, longer shelf life, and ease of use. Dry food colors are easy to blend, which makes them highly helpful for the growth of the food colors market in the foreseeable period. They easily enhance the appearance of various food and beverage options and extend their shelf life. Hence, they are used on a large scale by food manufacturers to produce food options in bulk.

Solubility Analysis

The water-soluble segment dominated the food colors market in 2024 due to high consumer demand, which is expected to drive market growth. Water-soluble food colors help maintain consistency and enhance food quality and appearance, which supports market growth. The growing beverage sector is a major driver of market growth, as it is the largest consumer of water-soluble food colors to make beverages look more aesthetic and attractive.

The oil-dispersible segment is expected to grow over the forecast period due to increased use of oil-soluble food dyes to enhance the visual appeal and quality of various food options. Oil-soluble food colors are widely used in the manufacturing of various bakery and confectionery items, such as sweets, chocolates, baked goods, and dairy products. Such food color options are sustainably sourced, natural, and organic, which will further support the growth of the food color market in the foreseeable future. Such options are an ideal alternative to artificial dyes for enhancing the visual appeal of various food items.

Application Analysis

The beverages segment led the food colors market in 2024 due to high demand for a range of beverages, including fruit juice, sports drink, ready-to-drink beverages, vibrant beverages, and other varieties. Such beverages need to look appealing to attract consumers and boost sales. Hence, the segment makes a major contribution to the market's growth. Different types of food colors used to make beverages more attractive, vibrant, and appealing help fuel the market's growth.

The bakery and confectionery segment is expected to be the fastest-growing segment over the forecast period due to high demand for various types of food dyes. The visual and aesthetic appearance of bakery items such as cakes, cookies, biscuits, and pastries helps enhance their sales, further fueling the market's growth. Higher demand for convenient, ready-to-eat food options in vibrant, aesthetic colors is another major factor driving the growth of the food colors market in the foreseeable future.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

Top Companies in the Food Colors Market

- Givaudan (DDW, The Color House) – Produces natural food coloring solutions including carotenoids, anthocyanins, and caramel colors for beverages, dairy, and confectionery.

- Sensient Technologies Corporation – A global leader in natural and synthetic food colors, offering clean-label pigments and advanced dispersion technologies.

- Koninklijke DSM N.V. – Supplies natural colors such as carotenoids and nutrient-based pigments used in beverages, bakery, and nutritional products.

- Archer Daniels Midland Company (ADM) – Provides a wide range of natural colors derived from fruits, vegetables, and botanicals for food and beverage applications.

- Chr. Hansen Holding A/S – Specializes in natural coloring ingredients from microbial and plant sources, widely used in dairy, confectionery, and processed foods.

- Kalsec Inc. – Offers natural spice and herb–derived colors including paprika, turmeric, and annatto with strong stability and clean-label appeal.

- Döhler GmbH – Produces natural food coloring systems from fruit and plant extracts, focusing on beverages and flavor-driven applications.

- BASF SE – Supplies carotenoids and other nutrient-based color ingredients primarily used in beverages, supplements, and processed foods.

- Symrise AG – Provides natural colorants, plant extracts, and integrated color–flavor systems for global food manufacturers.

- Naturex S.A. (Givaudan) – Offers botanical-based natural pigments including turmeric, beetroot, spirulina, and vegetable juice concentrates.

- ROHA Dyechem Pvt. Ltd. – A major supplier of synthetic and natural food colors with a global presence in beverage, dairy, and confectionery markets.

- LycoRed Ltd. – Specializes in tomato-based lycopene colorants and other carotenoid solutions used in beverages, dairy, and sauces.

- Fiorio Colori S.p.A. – An established supplier of synthetic colors, lakes, and blends used in bakery, confectionery, and processed food products.

- Allied Biotech Corporation – A global producer of β-carotene and carotenoid-based colorants for food, supplement, and beverage industries.

-

Sun Chemical Corporation – Provides synthetic food dyes, natural pigments, and specialty ingredients through its color materials divisions.

Segment Covered in the Report

By Type

- Natural Colors

- Synthetic Colors

By Form

- Liquid Form

- Powder Form

By Solubility

- Water-Soluble

- Oil-Dispersible

By application

- Beverages

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Processed Foods

- Snacks

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5917

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.